Personal income and spending both rose by 0.5% in January, the U.S. Department of Commerce reported Friday. The figures indicate the American economy is improving as household income increases and consumers show regained confidence by buying more.

Friday’s figures show a sharp improvement over December, when spending rose by a weak 0.1% despite record low unemployment and income growth.

The rise in consumer spending in January was the biggest since May 2015, and personal income was at its highest since June.

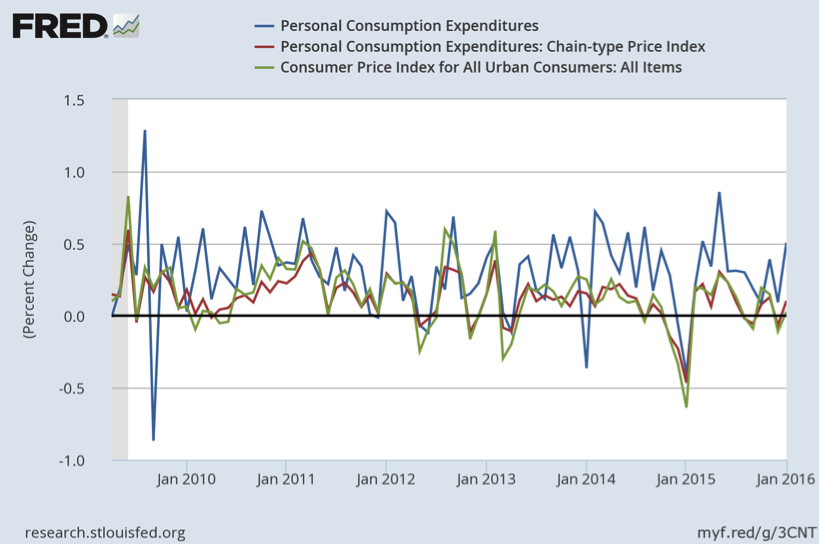

Despite these positive signals, inflation remains below expectations, struggling to reach the Federal Reserve’s goal of 2%.

“We started 2016 off on the right foot,” said Stephen Murphy, an analyst at Capital Economics, reflecting “a big bounce back in utilities spending as the weather returns to more seasonal levels.”

Purchases of durable goods increased by 1.1%, in contrast to a decrease of 0.4% in December. Purchases of nondurable goods increased 0.4 percent, in contrast to a decrease of 0.1 % the month before. Retail sales rose by 0.2% in January from the previous month. Overall consumers seem confident toward the American economy despite headwinds from the global economy.

The slowdown in the last quarter left some economists wondering about the strength of the economy and its future growth after the Fed’s decision to raise interest rates while oil prices are as low as $30 a barrel and a global downturn is looming.

But as Murphy pointed out, the underperformance of the personal income indicator in December was nothing more than the result of “the unseasonably warm and wet weather.”

, an economist and former professor at Zicklin School of Business, doesn’t share Murphy’s optimism.

, an economist and former professor at Zicklin School of Business, doesn’t share Murphy’s optimism.

“I think it is important to reserve judgment and don’t jump to conclusions, particularly when it comes to numbers coming out in January,” Brusca said. He explained that inflation had been low for long time, which will have a negative impact on consumers and income.

Despite the January figures, Brusca said, “income gains will continue to be weak” because we live in a global economy and “it is impossible for the U.S. to have significant inflation pressure when the global economy is weak.” On Tuesday the IMF, addressing the G20, defined the global economy as “highly vulnerable.”