Personal income rebounded in February after a dismal January, rising faster than expected despite tax hikes and looming federal budget cuts.

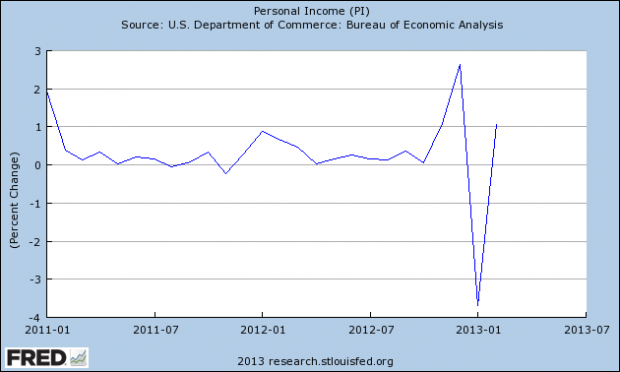

Buoyed by strong employment numbers, personal income increased by 1.1 percent, or $143.2 billion, the Commerce Department reported Friday, an encouraging correction following a volatile period that saw a sharp 2.6 percent increase in December and a precipitous 3.7 percent drop in January.

“What we’re seeing is a little more disposable income growth,” said Michael A. Brown, an economist for Wells Fargo Securities. “Not only do we have folks finding jobs, they’re earning more per hour and working more.”

According to the Commerce Department, private wage and salary disbursements jumped $42.4 billion. Goods-producing industry payrolls increased by $13.5 billion, manufacturing payrolls by $8.5 billion and services-producing payrolls by $28.9 billion.

The expanding job market caused the unemployment rate to fall to 7.7 percent in February, its lowest level in over four years, as 236,000 jobs were created.

There are also indications in the staffing sector that recent employment gains may be the start of a broader pattern.

“My work has picked up,” said Bruce Hurwitz of Hurwitz Staffing Services, Ltd., in New York City. “I haven’t seen enough of a steady increase to draw any conclusions, but this is the most positive sign I’ve seen.”

He noted a spike in payroll companies searching for new hires, something he interprets as a good indicator of potential employment growth in the months ahead.

“There’s nothing closer to jobs than payroll companies,” he said. “Each one of those positions speak to the fact that they have a bigger demand on their services.”

Increased hiring has in turn stimulated consumer spending. Personal consumption expenditures rose by $77.2 billion, or 0.7 percent, in February, the largest jump in five months and a marked improvement over the 0.4 percent seen in January.

“In the early stages of fiscal tightening, consumer spending is holding up and that’s about 70 percent of the economy,” said Robert A Dye, senior vice president and chief economist at Comerica. “So that’s a good sign.”

The personal savings rate also inched ahead, to 2.6 percent from 2.2 percent in January.

This all occurred amid higher taxes and the specter of enormous cuts in federal spending. In January, the expiration of the payroll tax holiday increased Social Security taxes from 4.2 to 6.2 percent. Dividend taxes went from 15 to 20 percent and the tax rate on individuals earning income over $400,0000 rose from 35 to 39.6 percent. The $85 billion in sequester-related budget cuts scheduled for March 1 created considerable unease throughout February. But the personal income and consumer spending numbers suggest these factors did not constitute that much of a drag.

Due to changes in fiscal policy, “We’ve seen some gyrations in the numbers,” said Dye. “I think we’re still seeing a little correction here in February.”

But the correction is moving in the right direction.

With the February gains in personal income, employment and consumer spending, the overall prognosis for the economy in the months ahead is more bullish now than before the numbers were released.

“As long as we have reasonable job growth,” said Dye. “I think the economy does feel like it has some forward momentum.”