Manufacturing expanded in February for the third consecutive month, as the economy overall continued to strengthen.

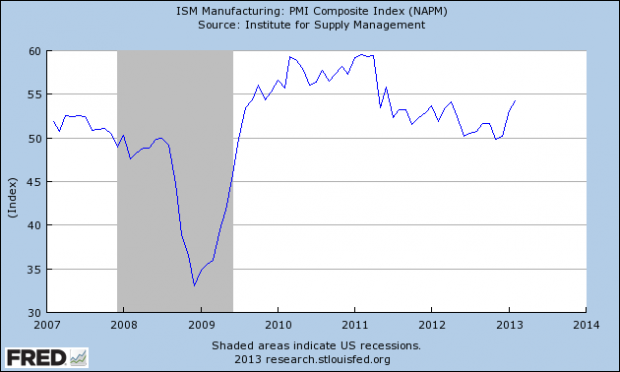

The influential Purchasing Managers Index (PMI) rose to 54.2 in February, up from 53.1 in January and 50.2 in December. The PMI is released monthly by the Institute for Supply Management (ISM), which tracks activity in the manufacturing sector.

A PMI above 50 indicates expansion; under 50, decline.

“It doesn’t happen very often that so many of our industries have growth all at once,” said Brad Holcomb, the ISM survey chairman and author of the report. “We’re off to a very solid well-rounded 2013.”

The ISM tracks manufacturing activity across 18 industries, including machinery, paper products, transportation equipment, appliances, apparel and furniture. Fifteen of the 18 expanded in February.

“Overall the report was broadly positive,” said Sarah Watt, an economic analyst at Wells Fargo. “Most industries reported increasing production, so that’s a pretty encouraging sign that it’s not just a few sectors that are doing well.”

A surge in new orders and increased production counted for much of the manufacturing growth, Watt explained.

“We saw the new orders increase to extremely strong,” she said. “That orders number alone was at its best rate since early in 2012.”

“We also got a nice solid boost in production,” Watt added.

Increased consumer spending on cars and an improving global economy also contributed to the high index, said Neil Dutta, head of U.S. Economics at Renaissance Macro Research.

“Manufacturing in the U.S. is a very export-sensitive sector,” said Dutta. “The fact that the global economy is showing signs of stabilizing is certainly going to help U.S. manufacturing.”

While all the component indexes that make up the PMI were above 50, some declined from January.

Employment was at 52.6, down from 54.0 in January, showing that business hiring slowed in the past month.

Despite a higher-than-predicted PMI for the past two months, economists predict only modest manufacturing growth through 2013. The still fragile economy is holding down consumer spending in most areas outside the auto industry.

In addition, the federal government’s continued fiscal woes make businesses hesitant to invest in new capital, said Watt.

But the budget cuts brought on by the sequester, which kicked in today, won’t be the disaster many dread, said Julia Coronado, chief North American economist at BNP Paribas.

“It will have an impact,” she said, “But it’s nothing catastrophic. It’s not that far beyond the fiscal tightening we’ve seen over the last couple of years.”