The U.S. Census Bureau releases its February advance retail sales report on Monday. Major economists predict on average a gain of about 0.2% from January’s numbers.

January’s report showed that the U.S. economy was still growing slowly compared to a year earlier. But if February’s data fails to meet expectations, chatter about a looming recession will surely grow. On the other hand, strong figures will calm nerves, at least temporarily.

Here are five things to look for.

1. An Improving Consumer Mood

The U.S. government shutdown and the uncertainty over its length led to some malaise in consumer spending in January. Many American workers were not receiving salaries, and tax refunds were also delayed because of the shutdown.

In December and January, savings rates surged among Americans as well, but no clear reason emerged to account for the sudden savings spree.

As soon as February arrived, many Americans had money in their pockets again. Government employees and contractors were back at work, and tax refunds started being processed. We should see that some financial swagger returned, and consumers probably showed it at the cash register.

2. Clarity to December’s Doldrums

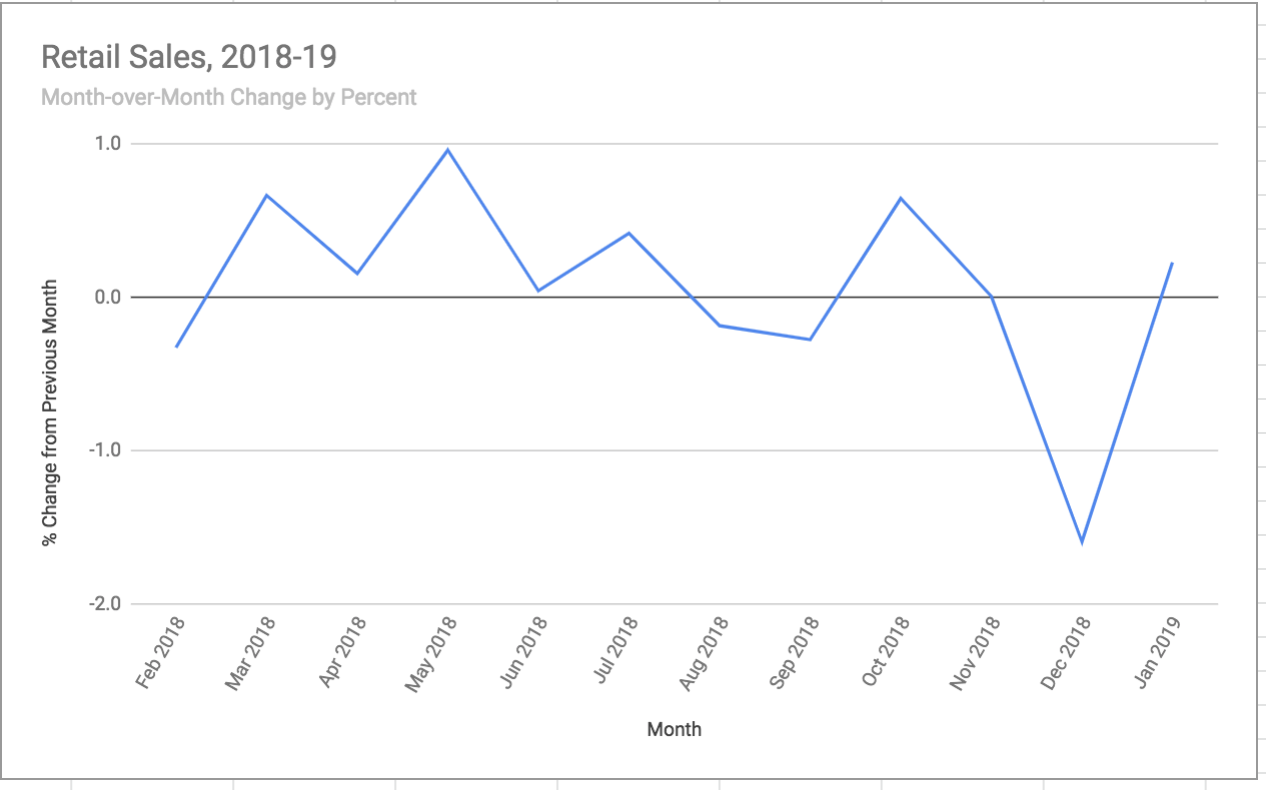

Economists are still struggling to explain December’s surprising retail plunge. Retail sales declined 1.6% from November to December, even though no data from other sources pointed to such a falloff.

While January’s rebound – which indicated a 0.2% increase from December – was a welcome bounce back into positive territory, it was too small to determine if December’s number was a complete aberration or a foreshadowing of coming economic struggles.

Other economic data, including jobs added and wage increases, continue to show some growth in early 2019, and that data would seem to be a promising harbinger for retail sales figures.

Since December’s release was delayed due to the government shutdown, some experts hinted that poor data collection may have played a part in the unexpected downturn. The census bureau refutes that claim.

But now that the government is finally back on schedule, a positive report for the second month in a row may put to bed fears that the sky is falling. December’s retail sale numbers could also be revised.

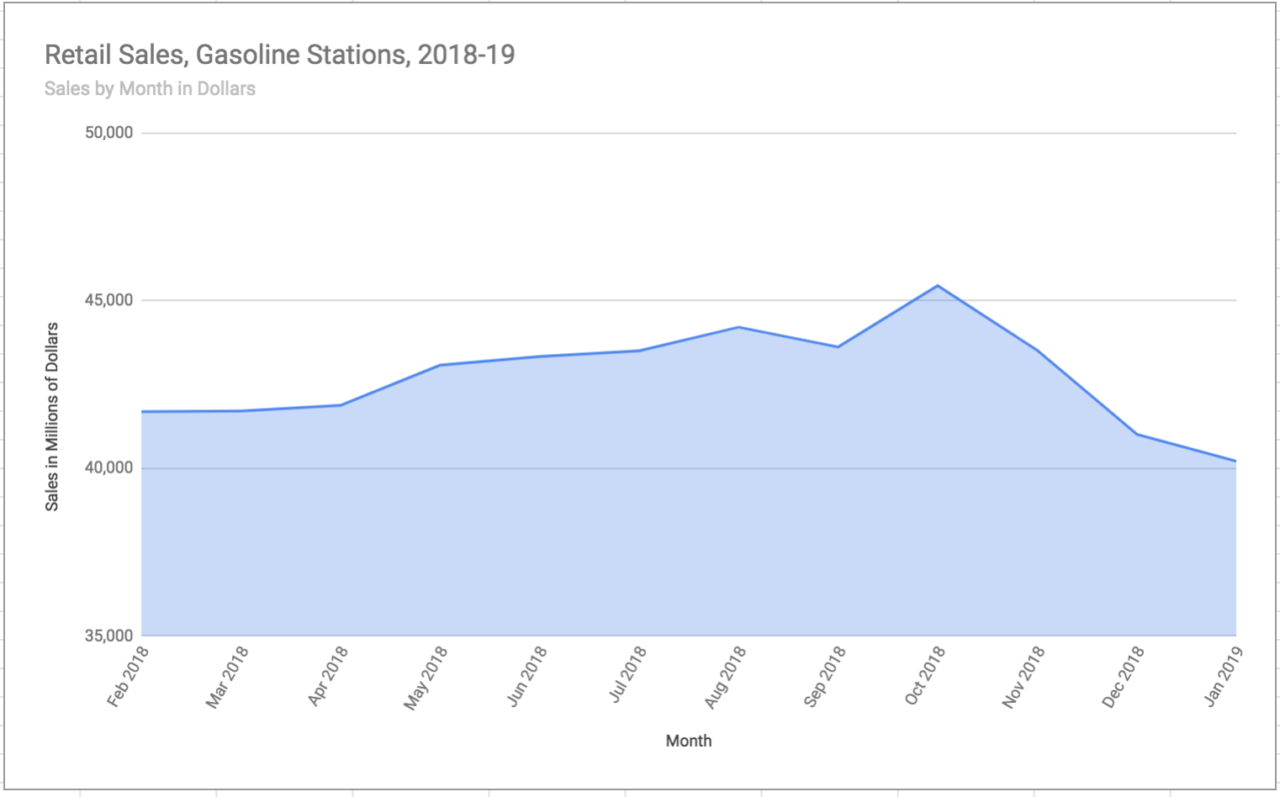

3. A Boost From Gasoline

Oil prices tumbled to their lowest point in over a year in mid January. While car owners might have welcomed affordable fuel, low gas prices helped suppress overall retail sales figures in the autumn and early winter. Month-over-month sales at gasoline stations dropped steeply between October and January.

In February, gas prices reversed course and shot up 1.5% according to the Consumer Price Index. Expect to see a bump in sales at gasoline stations, which should also contribute to positive retail numbers.

4. The Potential Weather Effect

Should the census bureau deliver an unexpected surprise Monday, we might be able to blame much of it on Mother Nature.

Several bouts of inclement weather hit the country in February, which limited consumers’ ability to leave home and spend. Few areas of the country were left unaffected. Cities from the Pacific Northwest to the Midwest endured their snowiest February on record. The South suffered from heavy rains and flooding. The East was also hit by heavy precipitation.

The category in the retail sales report typically immune from severe weather’s impact is nonstore retail, which includes ecommerce businesses. For the past few years, nonstore retail numbers have showed reliable and steady forward momentum. Although this category fell off steeply in December – as did most everything else – it recovered nicely in January.

The February numbers for nonstore retail – whether they indicate continued growth or a downturn – might provide a clue to overall U.S. consumer health.

5. Counteracting Forces for Building Materials and Supplies

The category in the report most susceptible to a large loss due to bad weather is building material, garden equipment and supplies stores. February started frigid in much of the United States thanks to a lingering bitter cold snap from late January, which disrupted demand for building materials.

But construction and housing data shows that completions of housing units had risen strongly in the second half of February. Mortgage lending also pointed positively.

The report will reveal which factor had a larger impact on building-supply sales or whether the two canceled each other out.