Home prices are rising steadily for the third month in a row across the United States, but that might not be as good you think.

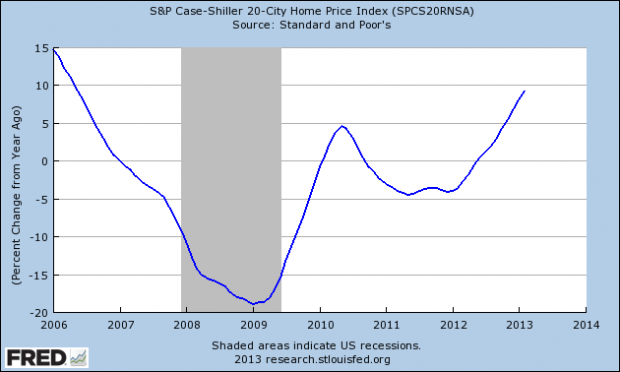

The Case/Shiller Home Price Index for February came in at 9.6 percent year over year growth, stronger than last month’s impressive 8.1 percent. And when seasonally adjusted, none of the 20 metropolitan areas tracked saw negative growth. To the untrained eye, this seems like great news.

But strong numbers do not necessarily indicate that the economy is recovering at the same pace, warns Nathaniel Karp, economist at BBVA Compass.

“We’re seeing significant home price appreciation not because the economy is booming but because we’re seeing the rebound that was bound to happen,” Karp said.

“But it doesn’t mean economic conditions are great and everything’s rosy,” he said, citing slow job growth and high unemployment rates across the country.

The problem is, if home prices keep rising and continue to outpace wage growth, less and less people will be able to afford to purchase homes. In turn, lenders will be more cautious about who they lend to, having learned from the housing crisis that taking on high debt to income borrowers is risky and irresponsible.

“It’s good in the short term for the seller because they can sell the home for more and make more money which they can then spend on consumption,” Karp said. “But then it drives up living expenses for everyone.”

Others are more optimistic.

Rising home prices give homeowners access to larger home equity loans, the market for which stagnated after the housing bubble burst, said Robert Dietz, economist for the National Association of Homebuilders. He believes people will once again use these loans as a resource. Some will invest in renovations, some will pay for their children’s college. But the point is, the money will be spent.

However the real winner of the steadily growing home prices is the building sector. As inventories of existing housing stock shrink across the country, and the prices of those existing homes continue to rise, people will look to build new homes. Contractors invest in equipment and hire workers.

And if March housing starts, which came in at the highest number in 5 years, is any indicator, this has already started to happen.

“At the end of the day more money flowing into residential investment means more jobs in the construction sector,” Katz said, “and gaining jobs in construction is positive no matter how small.”