It was a banner year for home prices: 2012 finished with higher-than-expected home values across the United States, shedding positive light on the overall state of the economy.

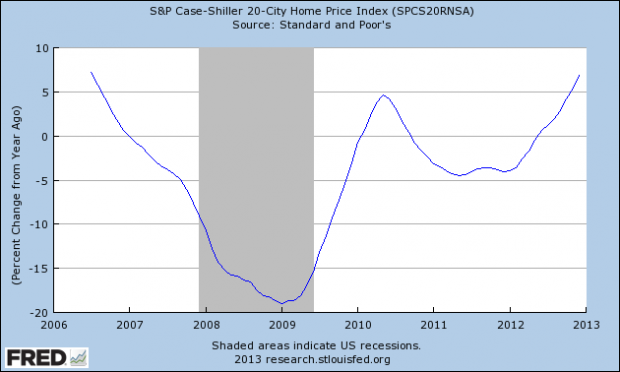

Home prices in December 2012 saw a 6.8 percent increase over December 2011 numbers, according to the S&P/Case Shiller Home Price Index, which tracks single-family home prices in 20 metropolitan areas across the United States. This was the largest monthly growth of a six-month streak that began in June 2012.

Rising home prices, combined with strong January home sales, show that the housing market is slowly rebounding from the housing crisis of 2007.

This is good for both homeowners and potential homebuyers because it shows that real estate is again becoming a stable investment. Brian Jones, Senior U.S. Economist at Société Générale said that six-months of modest but steady price gains are enough to quell investor worries about another run of rapidly declining home values.

“People are no longer concerned about trying to catch a falling knife,” Jones said.

Instead, they can expect a stable, improving housing sector — one in which investors can have confidence that they will make money instead of lose it. And confidence will lead to investment. Real estate investment as a percentage of the nation’s Gross Domestic Product (GDP), or the economy as a whole, has been abnormally low – 2.5 percent instead of 5 percent – since the housing bubble burst.

Hugh Johnson, Chairman of Hugh Johnson Advisors, LLC agrees that rising home prices will help GDP, but not just because people will be willing to invest in real estate.

“The rise in prices is like frosting on the cake,” he said. “But it’s not as though it’s an isolated event. It’s very important because the rise in housing prices has helped consumer confidence.”

Home prices are linked to consumer spending because homeowners spend money on their homes for things like furniture and utilities. When people’s homes are worth more money, they feel richer, and this means they’re more apt to spend money to make improvements and upgrades, helping the overall economy grow.

But rising home prices affect more than just homeowners and prospective homebuyers. A rebounding housing market will also be good for jobs and wages.

Construction jobs were the hardest hit during the recession, and an improving housing sector will inevitably lead to increased homebuilding and the creation of construction jobs.

Realtors will see wage increases, because realtor salaries are typically commission-based and depend upon the price of the sale.

However, we still have a ways to go.

Even with the 6.8 percent growth, today’s home prices match what they were in mid 2003, and they are almost 30 percent lower than their peak in July 2006. That means many homeowners remain “underwater” – their homes are worth less than the money they still owe on the mortgage. Economists say it will take several more years before most of those homes return to their pre-recession values.

And experts predict smaller home price gains in 2013, because higher prices will prompt more people to list their homes for sale, increasing market supply and stabilizing prices.

“We have to realize that there are tradeoffs,” said Jones. “This is the aftermath of a speculative bubble. But hey, you’ve got to start somewhere.”