By Madhura Karnik

President Obama has been trying really hard to revive the collapsed US housing market and to help US homeowners through various programs such as the HARP (Home Affordable Refinance Program) and the most recent $26 billion settlement for troubled homeowners. But, these efforts do not seem to be the ultimate solution for improving the health of the housing market in the long term.

A major part of the government’s efforts to improve the financial health of the housing market and homeowners has been the availability of refinancing. First with HARP, launched back in 2009 and most recently with HARP 2.0, introduced on January 9, 2012. The main objective of these programs is to make available the homeowners easy refinancing options. But, refinancing has a very minimal impact on home prices, which are currently at an all time low. Stabilizing the home prices is the biggest driver behind reviving the housing market.

All refinancing does to home prices is it reduces the impact of a foreclosure if the borrower had not refinanced. So, if a home was valued at $200,000 and it fetched $70,000 due to foreclosure, the same house would have fetched an amount equivalent to its value, if the borrower had refinanced. Refinancing results in a correction in home prices only to the extent of the foreclosure discount, which in the above case is $130,000.

Although, refinancing has an impact on the home prices, it is limited to the short term.

“Its just a temporary adjustment,” said James Kahn, ex- Vice President of the Federal Bank of New York and the current Henry and Bertha Kressel Professor and Department Chair, Economics at Yeshiva University. “Refinancing avoids the price decline in the immediate term.”

Kahn also says that it will not fundamentally help in the long term.

Albeit criticisms, some business groups like the realtors favor refinancing. Blane Johnson, owner of Incline at Tahoe Realty, a realty firm in Nevada and the President of the Nevada Association of Realtors believes that refinancing has a positive impact on the spending capacity of the borrower.

“Refinancing reduces the overall payment and owners can stay longer which means there is more money for borrowers,” said Johnson.

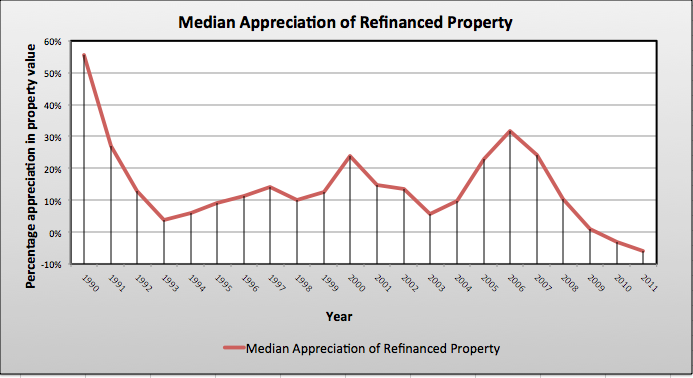

Although refinancing has historically appreciated the property value, in recent years the appreciation is declining and has even been negative for the year 2010 and 2011 (See chart above.)

With the HARP 2.0, the government has further expanded the scope of refinancing by eliminating the cap on negative equity limits. Negative equity, often referred to as “underwater”, means that borrowers owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in value, an increase in mortgage debt or a combination of both.

Nevada has the highest negative equity percentage with 61 percent of all of its mortgaged properties underwater, according to a report released by Corelogic, a mortgage data analytics company, earlier this month.

Johnson is hopeful that the new HARP will benefit some borrowers in his state, although the flipside is that only mortgages backed by Freddie Mac and Fannie Mae are eligible which means a large number of borrowers are ineligible.

He thinks that a new bill proposed by US Rep. Joe Heck, in Nevada, called ‘Second Chance’ which would give homeowners who already under foreclosure, an option to refinance, could be more helpful than HARP for a state like Nevada which was most affected during the crisis. The Nevada Association of Realtors is backing the proposal.

Residential Mortgage advisor Dan Keller says that even if HARP 2.0 sounds like an efficient program, the government has still not clarified the guidelines for the processing.

“If the government imposes strict guidelines to implement HARP 2.0, then the targeted audience of 7 million homeowners would be further reduced,” Keller said.

The main idea behind refinancing is to decrease the future toxic inventory in the market, believes Ken Fears, Manager of Economic Services at the National Association of Realtors. However, Fears is still skeptical if the current refinancing plans will improve home prices in the future.

“Foreclosures will continue for the next two years so even if the consumer sentiment is strong, the shadow inventory will weigh down the prices,” Fears said.

Unless all the toxic assets are washed out from the market and strong demand resurfaces, the housing market will continue to be at its battered best. With HARP 3.0 in the pipeline, which promises to take care of mortgages not backed by Fannie and Freddie, refinancing might have a better impact next time around.