This Tuesday morning will mark the release of the S&P CoreLogic Case-Shiller index with data covering home prices for March 2021. All eyes will be on whether or not the housing market has been able to maintain its exponential growth.

Here are five things you should look out for in the upcoming report.

DECREASED NATIONAL GROWTH RATE

The general expectation is that the housing market will continue to grow at its elevated rate and is all but guaranteed to reach double-digit gains for a fourth consecutive month going back to last December. However, not many economists believe that the growth rate for March will be higher than what was seen in February.

In the report showing February’s data, home prices climbed significantly, reaching 12% growth in year over year gains but economists for Econoday believe that the growth rate for March will decrease slightly to an 11.8% yearly gain. If that turns out to be the case, it will be a significant gain nonetheless.

FEWER HOME SALES

As a result of the fast-growing market, buying a new home has become less affordable for many Americans. This, coupled with the housing inventory shortage, may result in a continued decrease in the number of new houses that are being sold.

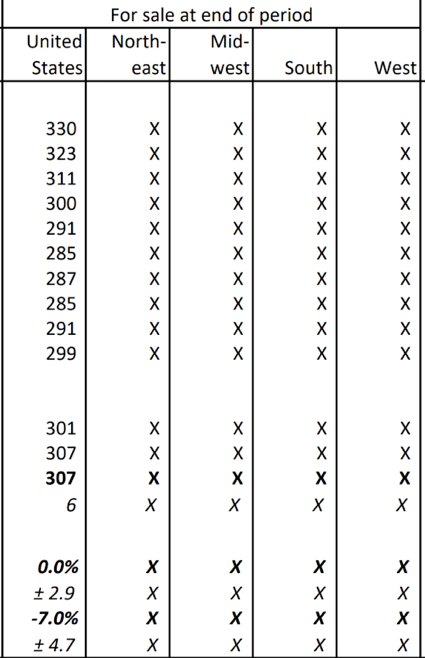

The number of new homes being sold had reached its peak near the start of the year and has been slowly decreasing since then. That trend is expected to continue, especially if prices continue to grow at this rate and according to the U.S. Census Bureau and Department of Housing, there were 307,000 yet to be sold houses in February and March, the highest total since last May.

RECORD GROWTH ALONG WEST COAST CITIES

Cities along or near the west coast have seen significant growth in February, which some believe is the beginning of a trend that can see even more increases in these markets.

Home prices in Seattle went from 1.4% to 2.1% between January and February while San Diego and San Francisco each saw jumps of nearly two percentage points. San Diego saw home prices increase from 1.4% to 2.9% while San Francisco saw prices jump from 0.8% to 2.4%.

These increases suggest that those markets could be facing another trend, rather than a one-off increase.

INCREASED MORTGAGE RATES

After mortgage rates dropped to a record low of 2.65% for 30-year mortgages in the first week of January 2021, rates have slowly been on the rise again. By the start of March, 30-year rates made it back to the 3% mark for the first time since Last summer and reached as high as 3.18%, the highest it’s been in 12 months.

According to Elliot Eisenberg, Consulting Economist to American Pacific Mortgage, mortgage rates will have the capacity to be extremely volatile over the next few months, possibly more so than ever before.

VACCINATION EFFORT

Vaccinations in the U.S. began picking up significantly in March with an average of more than 2 million doses being distributed per day. This has become one of the reasons that in-person work and classes have also been picking up traction. Some economists believe that an influx of remote workers and students returning to in-person activities may result in a sudden need to relocate and an increase in active home shoppers.