The Bureau of Economic Analysis will release its March personal income and spending report tomorrow, where both income and spending are expected to plummet. This will be the first dataset of its kind that will start to reflect Covid-19’s impact on consumer behavior. Here’s what to be on the lookout for:

1. A fuller picture of what happened in March

In the timeline of Coronavirus events, a lot happened in March. Coronavirus was still on the periphery for the first two weeks, until a national emergency was declared on March 15th, ordering businesses to shutter and many Americans to stay home from work in an attempt to “flatten the curve.”

Unemployment data gathered for the March jobs report occurs in the first two weeks of the month, meaning that much of the impact on income wasn’t fully reflected in the March jobs report. Thursday’s income and spending report will help to fill in gaps and more accurately assess the tail-end of the month.

2. Income to plummet

Over 700,000 jobs were lost in March, bringing the unemployment rate to 4.4%. The number of unemployment claims continued to quickly climb throughout April, totalling more than 26.5 million. As businesses are forced to lay off and furlough workers, income and wages are expected to drop dramatically from February’s .6% increase.

“Any measure of economic activity is an indication of income,” said Christopher Low, chief economist at FHN Financial. “If someone is buying something, paying for something, it’s income for somebody.”

The report will also add clarity on the impact of other income, such as rent, and if widespread job loss had an immediate impact on tenant’s ability to pay their monthly bills.

3. Absence of relief from stimulus checks and expanded employment benefits

One of the reasons why income will appear so dire is that plans for economic assistance will not yet be reflected. President Trump signed a historic $2 trillion relief package into law on March 27th. The measure contained both expanded unemployment benefits as well as one-time stimulus checks to be distributed to Americans meeting income criteria.

However, the programs have been slow to roll out, with many Americans still waiting on their stimulus checks as May nears, and state unemployment systems buckle under a tidal wave of sudden applicants.

While the March report will reflect a moment in time where the economy was in free-fall with no safety net, income numbers can be expected to rebound slightly in April as aid trickles to Americans.

4. A sharp decline in spending

With most stores forced to close, and millions of Americans finding themselves jobless, they are spending less, especially when it comes to discretionary goods like clothes. Retail sales plunged 8.7% in March, the most drastic shock since data has been tracked.

Economists do not suspect that the widespread “panic buying” of groceries and toilet paper that left shelves across America barren will significantly offset the lack of consumer activity in areas such as hospitality and travel. The decline in spending will end a period of consistent 0.2% monthly growth in 2020.

5. Savings to increase

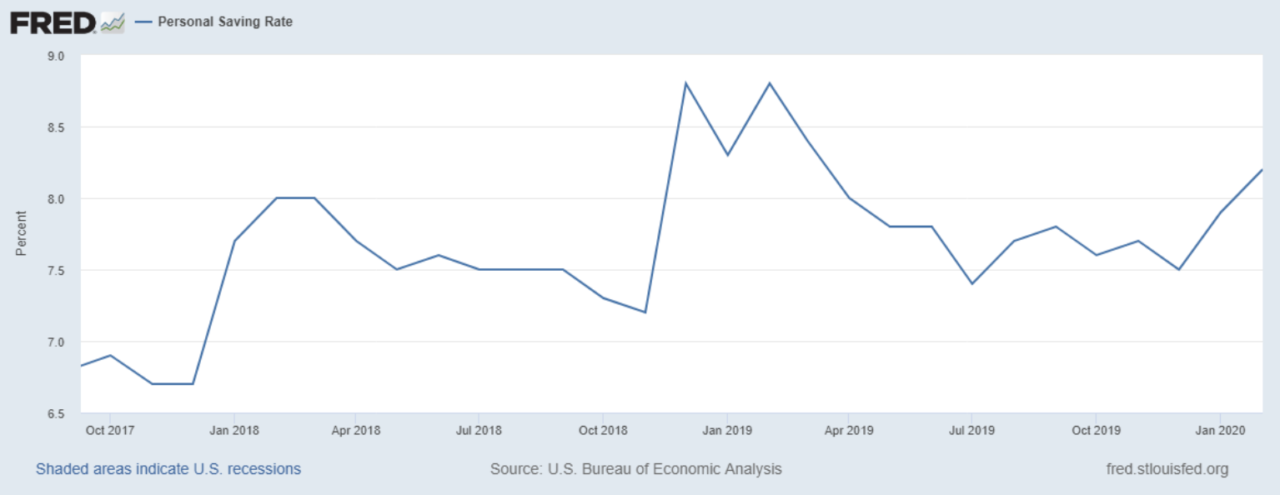

With businesses closed and a solid chunk of Americans still able to work from home, saving should see a significant bump, continuing the upward trend from last month’s increase to 8.2%.

“Those who are being paid are not spending as much, they are saving more,” said Low. “Those who are not being paid are finding it more difficult to access credit, so they’re not dissaving as much as you might expect.”

However, the longer that the coronavirus continues to shut down the economy, the more likely it is for even Americans who are able to do their jobs from home to find themselves unemployed. In that case, an increasing number of Americans will be forced to dip into savings if they have not already had to do so.