Consumer prices rose modestly in February after a three-month period in which prices remained unchanged, suggesting moderate inflation throughout 2019.

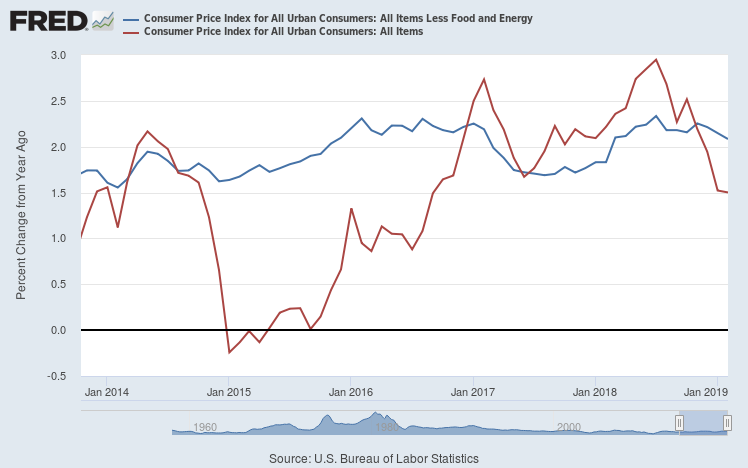

The Consumer Price Index, which measures inflation in the United States economy, increased by 1.5 percent over the last 12 months, the Bureau of Labor Statistics said Tuesday. This figure is well below the 2 percent inflation rate that the Federal Reserve Board targets as sufficiently low and stable. But this number reflects volatile energy prices, which dropped 5 percent in the last 12 months. Over the last year, the more stable “core CPI,” which excludes energy and food items, increased by 2.1 percent.

“Inflation is muted,” said Jerome Powell, chair of the Federal Reserve, on “60 Minutes” on Sunday.

Economists predict increases in the CPI well within the Federal Reserve’s target range for the rest of 2019. Prices of services, which make up about 63 percent of the American family’s budget, are expected to continue to grow, but they will be offset by small or no price increases for goods other than energy and food. “There’s little reason to expect any major pick up in inflation over the next year or so,” said Bill Diviney, senior United States economist for the Dutch bank, ABN AMRR Bank NV, who just released a report on inflation expectations.

Wage Increases Unlikely to Create Inflation

Inflation remains muted even though wages in the United States are on the rise. “There is still room for wages to move higher based on what’s been happening in the economy in recent years,” said Michael Gapen, chief U.S. economist for Barclays Capital Inc.

Diviney of ABN AMRR Bank NV said, “Productivity growth is picking up, and that is helping fund wage increases without raising labor cost inflation.” He attributed this increase in productivity to a few years of strong investment in the wake of the 2008 recession. “We’re seeing the fruits of that now,” he said.

Increases in Energy Prices. No Big Deal

Gasoline prices decreased 16 percent between October and January. Then, in February, they rose 1.5 per cent.

Toni Anne Enneser Ehlers, 55, who commutes 26 miles a day between West Islip and Hauppauge, Long Island, has noticed the change. “But it’s very slight,” she said, adding that the price of gasoline increased about 5 cents a gallon, to $2.45.

Ehlers, an administrative assistant for an elevator company, said she begins to feel the pinch at $3 dollars a gallon.

“Given our outlook for oil, we don’t anticipate it to play a major role in inflation trends,” said Gapen.

Surprise Deflation in Some Important Goods

With the turnaround in energy prices and food prices picking up, forecasters predicted that February’s monthly change in CPI would be greater than the reported 0.2 percent.

“The main reason for the downside surprise was a weakness in medical care commodity prices or prescription drugs, and in new and used autos,” Gapen said.

He attributed the decrease in prescription drug prices to an unexpected replacement of brand-name prescription drugs with generics, adding that higher interest rates, and the preference of auto companies to keep production high in a slowing global economy, helped push down the price of new cars.

Nirvana Doesn’t Last Forever, but Reality Won’t Be Too Bad

Wages are increasing, while gasoline, drugs and cars are getting cheaper. But wage growth will eventually force companies to make a choice: either they maintain prices and reduce profitability, or they start passing increased costs on to consumers. “It’s usually a combination of the two,” Gapen said.

Since the early 1990s, in the United States, goods prices have not been affected by wage increases because productivity in the goods sector is very high, and because of strong international competition.

In contrast, the service sector has traditionally been sensitive to wage growth. “Service sectors are more geared around labor costs, and they face less international competition,” Gapen said.

“But we are expecting only mild inflationary pressures,” he added. “We’re not thinking that a significant surge in inflation above 2 percent is likely.”